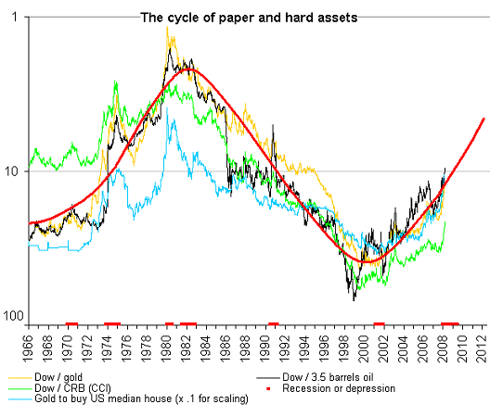

The price of oil is climbing but we're not using that much more of it right now because the economy is so weak. The reason, of course, is that they are trading printed money for money that, as Dennis Gartman is fond of saying, would hurt if it fell on your foot. That's the way it has always been and always will be. And it tends to run in historical cycles:

Those who say the bull market in commodities is over are probably wrong. This chart suggests that we are maybe half way through the current substitution move of stuff for paper, as it normally progresses. But that was before the credit debacle had the dual effect of setting the prices of commodities back nearly to levels at the beginning of the commodity bull and inducing the unprecedented money printing spectacle we are now witnessing. Throw in the rise of India and China as insatiable consumers of commodities, and we may be setting the stage for a monumental sling shot catch up trend of stuff for paper substitution such as the world has never seen. Oil had been reset to $30/bbl and nat gas to $3 and change - prices they haven't traded at since 2002, and now they have dumped this humongous load of paper smack dab on the 10 "yard" line in the above chart. The may have to call an unnecessay roughness penalty on the upcoming move in commodities.

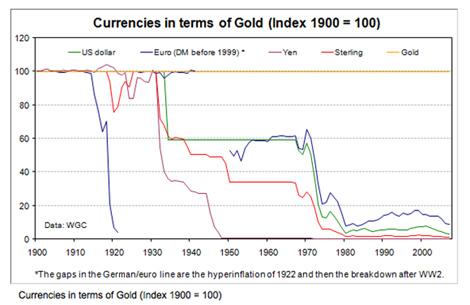

The chief unprintable money is gold, and for good reason. The following graph shows a value comparison between the barbaric metal as money and the world's various bills as money:

Every shakeup that comes along results in more paper money going by the way side. I would hazard a guess that our current problems will result in a big gold and stuff substitution for printed money.

No comments:

Post a Comment