This is simply the "new" energy we did not have to spend in past decades to recover the old energy. This may not sound like such a big deal at first. But when you look at the math, you see much more of an energy crisis brewing than just peak oil itself.

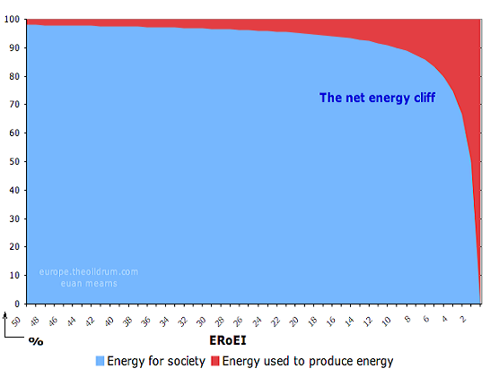

The above chart, a purely mathematically calculation, shows basically the progression of our oil age in terms of net energy. We enjoyed an Energy Returned on Energy Invested (EROEI) ratio of an estimated 100 or so when you could just poke a shallow hole in the ground and be handed an ocean of energy. Of course it got tougher as all the elephant, easy to develope fields played out and oil got much more difficult to recover; and now it's running around 8 to 12 depending on whose tabulation you go by. But look at what happens in the above chart as you go below about 6. EROEI becomes a game changer.

Not only is EROEI a game changer for oil, it is of paramount importance in developing all forms of oil-age alternatives - ethanol, solar, everything. Anything with EROEI less than about 3 is virtually useless in replacing oil. And even oil will become useless in replacing oil when the EROEI goes 'round the bend in the chart.

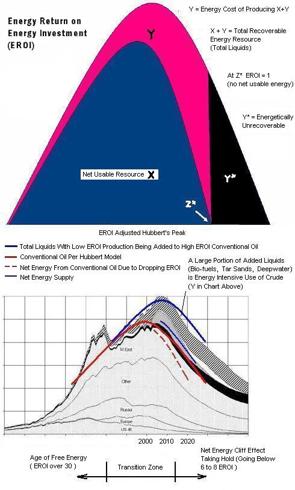

This translates into an "EROEI adjusted" Hubbert's peak that would look something like this:

Most all of the nonconventional liquids being added to the conventional curve (which peaked in 2005) such as tar sand oil, deepwater oil, and most of the bio-fuels are very low EROEI and do not contribute as much to the total energy curve as usually depicted. The last half of the net energy production curve winds up looking vastly different than what we have been spoiled by for decades.

The implications of this growing net energy effect are probably more upward pressure on oil prices than what most projections see that just add up barrels from new projects, factor in field decline rate (in barrels) and basically treat all barrels the same. It also means driller demand will grow exponentially as we go around the bend in the above chart.

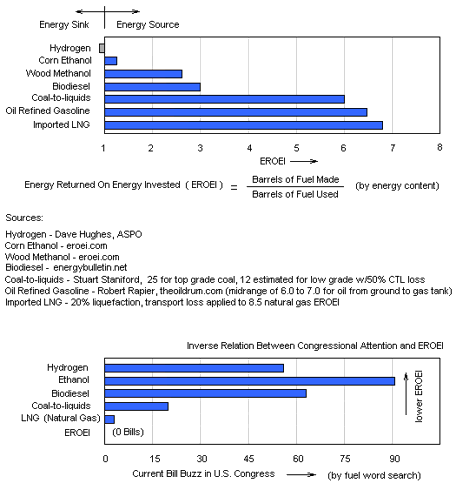

As we head toward the edge of the net energy cliff, we have just a very limited window of time to stop the corn ethanol and other EROEI challenged foolishness and seriously develope energy sources not already near the bottom of the cliff. EROEI should be a prime focus of attention in Congress, but sadly it is not. In fact, as the following chart shows, the law makers and money spenders are actually looking the other way when it comes to the net energy cliff in front of us.

Bruce- why aren't the various forms of nuclear included in this analysis ? Thanks- jak3

ReplyDeleteNuclear energy is much too capital and time intensive to make a significant difference. It is my personal belief that if the authorities decide to pursue a nuclear path, we will likely end up expending enormous amounts of precious time, energy and human development capital, and wind up hundreds of useless hulks or holes in the ground.

ReplyDeleteThe hard political decision is to explain to the people the that the era of cheap energy is over, implying a return to a vastly simpler way of life for the people of the 'developed' world. A prerequisite of such a transformation will be a massive redistribution of wealth (access to energy & resources).

A major complicating problem in implementing such a strategy in the relatively short time likely available is the existence of about 25,000 nuclear weapons, with about 6 or 7,000 on hair trigger alert. Michael Klare predicts an increase in regional 'energy wars', any one of which could lead to nuclear catastrophe.

Barry Commoner (and others) articulated the present conundrum 30 years ago in "The Closing Circle." The window of opportunity to act may have closed.