I have found that investing is most easily done by identifying megatrends and working mostly within that area of the market with individual stock analysis. Studies have found that half of a stock's movement is a function of what its sector is doing. So if you're right about the major sector trends, you take positions in the best stocks and let them ride and trade only for very good reasons - "be right and sit tight" as the saying goes.

Gold is the megatrend right now. But all megatrends end. So what's after gold? If you're an investor who attempts to correctly switch horses when they die, you need to be thinking ahead and preparing to mount the next horse when the one you're charging ahead on is shot out from under you.

Before we consider what could possibly emerge as a megatrend after gold, let's first think about the shooting of the gold horse. I suppose the first thing that comes to mind when thinking about the end of something as hot as gold is your classic blowoff top followed by a catastrophic collapse that goes on for many years. This is what is thought of as coming after a parabolic rise. Isn't that what the Nasdaq of the 90s did and gold in 1980? Well, I would direct your attention to my previous article "The 64 Month Bull Market Fractal" to point out that the parabolas sometimes end that way, but can end with a jarring disconnect from the parabola followed by continued high range pricing and new highs - just without the nice smooth parabola. There is a current

article over at Kitco by Chris Blasi suggesting that the macro economic conditions are so different now from 1980 that it almost dictates a different outcome in this gold bull market:

Not a 70's gold bull replay.

True, gold's last bull run gave way to 20 years of price erosion, ratcheting down to the lowly exchange rate of $255 per ounce. Regardless, the US and global economic landscape of 2010 is vastly different than that of 1980. Today's exponential growth of sovereign debt is straining confidence in faith based currencies, particularly one which holds the mantle of world's reserve currency. This current debt differentiator, in conjunction with a myriad of other issues inhibiting US economic growth, is substantial enough to reasonably assure investors of a strikingly different course and conclusion to this gold bull.

Take a look at the US debt chart in this article and visibly compare 1980 to now - a vastly different condition as to its rapid healing prospects. So the shooting of our gold horse may actually be more of a moderate hobbling - but something to avoid nonetheless.

So what about a new megatrend to watch for? How about oil? When oil was passing $80 a barrel two years ago, it was about the only game in town and funds were loading the boat with it. All the oil bears were crying "speculative bubble", and when the financial collapse came in '08, it was just that -

everything was a collapsing bubble then. Now oil is passing $80 a barrel again, and oil and the energy stocks are

underperforming just about everything. They are the dog of the day now. You certainly can't blame the pricing on a frothy frenzy this time.

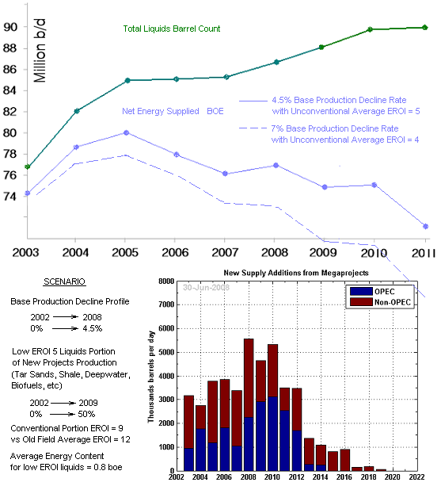

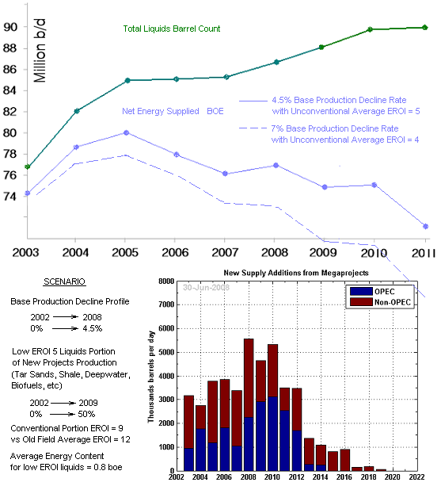

I think the price of oil may surprise and confound what I call "the barrel counters" - the energy planners who by and large are blind to the net energy crisis brewing in the world. They don't understand the profound decline in net usable energy coming from the industry. If you tabulate a real net usable energy curve, which

used to be about one and the same with the raw barrel count, you get this disturbing picture (click to enlarge):

A sharp divergence between net energy and official barrel count began to emerge in 2005 - about the time the price of oil started going crazy. The Great Recession has perhaps camouflaged the real usable energy supply shortage since 2008. But now we have a recovering global economy matched against a steepening divergence between usable energy and barrel count - a double whammy that could bring three digit pricing back before we think. Crude alternatives are stepping in to fill the gap, but probably not fast enough. Oil has been a dog. But I have a hunch this dog will have his day.