One of the most perplexing problems for a stock picker (as opposed to a market analyst) is knowing when to be aggressive and when to be defensive. Bottom up individual stock analysts like me ask nothing of the overall market. The ideal market for us is perfectly flat, not interfering with our individual stock dynamics at all. We don't like overbought or oversold stock markets fretting or celebrating anything. But in the real world, market stampedes trample our well thought out analysis right and left. So we have to be something of a market caller whether we like it or not.

So how do you best do this? Well, you could try to figure it out yourself, but if your talent is individual company prediction, you're likely not very good at calling every market turn. There are people that make it a full time job to study nothing but the market turns and you must pay them for their advice if they have a good track record, and a few of these are good enough to keep you on the right side the vast majority of the time. But even the ones with the best records will lead you into a lot of unnecessary market dodge ball at best and they often lead you right into big market debacles.

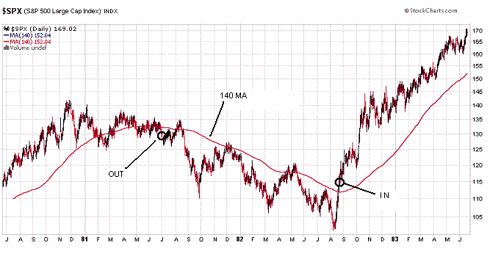

There is a very unsophisticated way to stay on the right side of the market. If you look at about any 20 or 30 year history of the market, you observe that if you simply stay away from the market when it's below the 140 dma, you avoid about all the disasters. That's because the vast majority of damaging downdrafts are economic trend induced and thus they come on gradually and advertise their arrival very well with moving average crosses.

If you take the period from 1980 to now and let Doctor 140 be your highly paid advisor, you would start out something like this:

If you allow about two months after a cross below the 140 to see if the market takes up residence there instead of just spiking below it, this can filter out a lot of noise, but it's a little subjective as to when a brief dip justifies a lot of selling. Usually, when a major average spends most of two months below a 140 (or 200) cross, it's a negative signal. Dialing a portfolio back in can begin when a forceful cross is seen that doesn't immediately come back down.

The S&P 500 over this period went from 115 to about 900 now. That's a 682% return. Just doing a rough hand tabulation of what a fund would have done had you done nothing for market advice except listen to Doctor 140, I get about a 1290% return over the same period. That's if you would have only matched the S&P 500 while in the market!

It would not have kept you out of the crash of '87, but nobody is perfect, and Doctor 140 is more perfect than most.

No comments:

Post a Comment