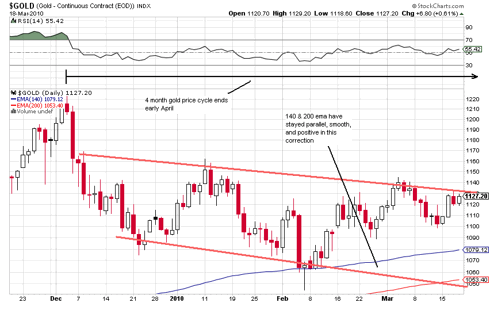

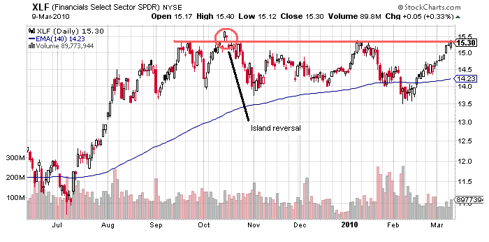

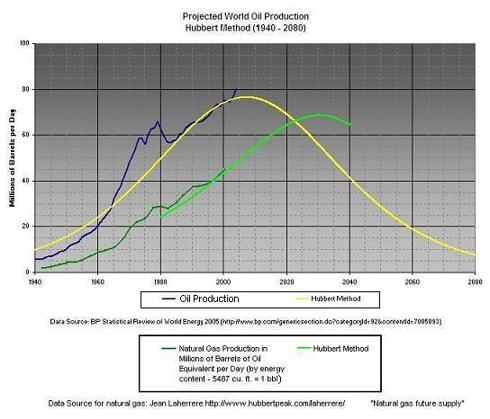

First, oil and gas are peaking at two considerably different time frames globally. (click to enlarge charts)

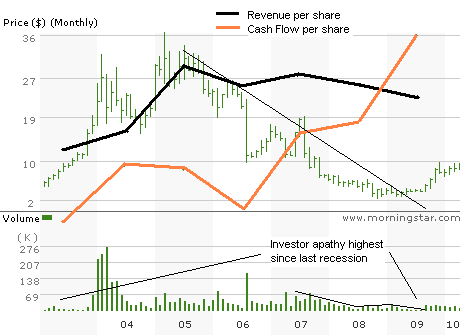

This was never a big deal in the past because both production curves advanced in unison. But now in 2010 (check the above chart) we are going into the "criss-cross" where oil is fast becoming a lot more dear than the gas. This chart actually understates the case because gas production produces NGL (natural gas liquids) that condense out of the gas processing and are added to the official "oil" supply numbers, about 8 million barrels a day worth of our 85 million barrel a day habit. This fat portion of our oil is actually natural gas production energy. The above chart illustrates why natural gas is often referred to as the "bridge fuel" we need - a bridge of about 25 years between the oil peak and the gas peak to safely get us across to the nonfossil fuels of the future, like sugar and cellulosic ethanol, scaled up to what we need. Oil companies that used to discard gas like a candy wrapper to pump their oil finds are now making moves to develope gas as the main attraction, because they are beginning to realize that natural gas is becoming at least as primary a fuel of the future as crude.

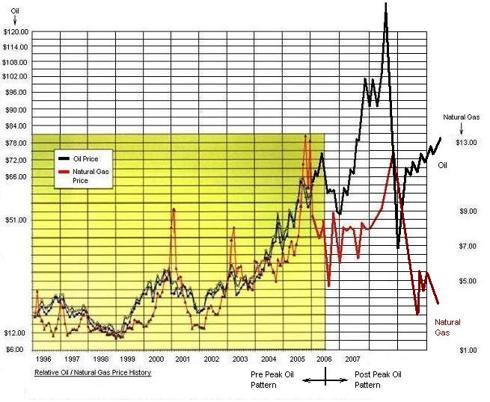

To greatly aggravate this disparity between oil and gas supplied energy, technology breakthroughs in gas drilling are now making it possible to recover vast amounts of gas entrained in shale rock that have always been known to the industry but deemed unrecoverable. North America is blessed with a Saudi-like supply of this stuff, and it is why the above mentioned bridge could be lengthened beyond 25 years and it is why the price of natural gas is about the only thing going down these days:

Inside the golden box, the 6 to 1 pricing guide held pretty well. When the ratio got out of whack, you could pick which one was more typically priced and expect the other one to soon come into line. But now you have to think outside the box, horrible pun intended. The current ratio is over 20, and I don't think it will be near 6 anytime soon.

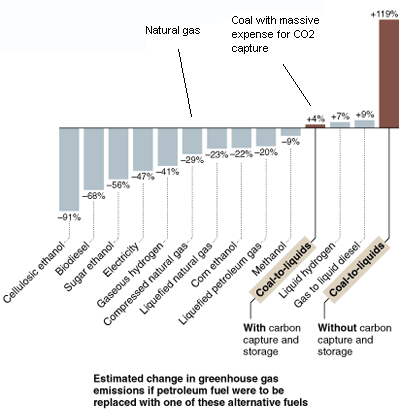

All this explains why it is so tragic and insane to slight cheap domestic natural gas drilling in favor of expensive and highly toxic and geopolitically suicidal oil imports and greenhouse gas challenged domestic coal. "Clean coal", according to Jim Cramer, is an oxymoron invented by the black lung coalition lobbyists. Making coal anywhere near as clean as nat gas already is will nearly bankrupt the country - just what we need now:

It should be noted that about all the alternatives to natural gas, except sugar ethanol and maybe some future cellulosic forms, suffer from a big net energy problem. It takes about as much energy from oil to make it as it replaces - no solution to a vanishing oil supply.

The current U.S. Congress has a bias against natural gas, but other nations around the world aren't so dumb and run a large portion of their fleets on natural gas. They pay much less per gallon equivalent. Boone Pickens points out that 7 gallons of diesel is the energy equal of one MCF - current price is $3.00 a gallon of diesel times 7, or $21 vs about $5 an MCF of gas. But you have to put up with your engine oil staying clear as the day you put it in and your engine lasting much longer.