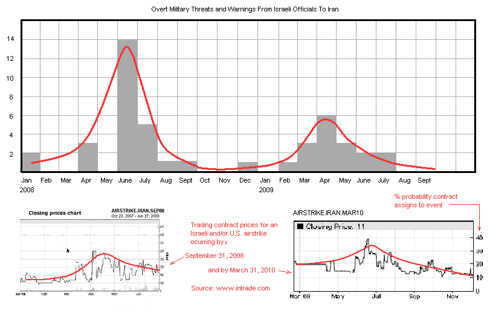

Israel's Defense Minister Ehud Barak has just given an assessment to the Israeli parliament where he said Iran will possess the technology to build a nuclear bomb by early 2010. He said they would surely be building bombs in 2011 if allowed to proceed. About a month ago, he stated that the Iranians had reached a technical breakthrough that would facilitate a quick advance in their nuclear capability. He was probably referring the the nuclear trigger, a technology that even Iran's apologists at the U.N. say has no peaceful use.

Also happening this week - a complete recall of all Israel's diplomatic crew, ambassadors and whatnot, from all over the world to meet in Israel. This is unprecedented and is causing speculation that the Israeli military has made the decision to strike Iran and this meeting is to PR it to the world when it happens.

STRATFOR, meanwhile, published an intelligence report Dec. 21 on the "invasion" by Iranian troops into Iraq to take over an oil field. This sounds alarming and had Larry Kudlow pounding the Kudlow Report desk demanding that Obama declare war immediately. But this oil well thing happens on a regular basis in that area, like a Hatfield and McCoys feud, because the border there is not defined very well and both countries claim the well. An Iranian bunch comes over now and again and puts an Iranian flag on it for a week or so, then they go back home while the Iraqis paint their colors back on it. I think I even read it's a nonproducing well - a silly, benign spat as Middle East spats go.

So why is STRATFOR so concerned with it? To quote their recent article, "what would be fairly trivial at another time and place is not trivial now". They feel it was orchestrated this time, reportedly ordered by Tehran, simply to make a point to the lynch mob assembling against them without triggering a precipitous response. That point is that Iran does not have to let Israel or the U.S. make the first move. Iran is well aware of the goings on in the intel and military community and just wants to rattle the chain of Obama and the other decision makers amidst their orderly deadlines, preparations, and any other American timetable for Iran.

This raises the whole question of who is going to throw the first punch. When you think it through, you realize that the war is going to be a sea war, not an air war. Iran's air force is not a problem for Israel nor is their air defense system (until they get the S-300). With the right bunker busters (they may wait for the MOPs), taking out the nuclear program is the least of the worries. But Iran's navy is another story. They have sophisticated anti-ship missiles and other maritime hardware with which to carry out their only real threat of war-making, and this would be fought on the waters of the Gulf and with the price of oil. They also hold the card of massive incursion into Iraq, which they hinted at with their recent stunt. STRATFOR concludes that the initial strike may not be the air strike out of the blue on the nuclear sites, but a smashup of Iran's navy in the Gulf and their military in or near Iraq. Iran faces a use-it-first-or-lose-it dilemma which may goad them into a pre-emptive strike in the Gulf to pre-empt Israel's pre-emptive air strike. Their take:

"When we look at the three Iranian options, it is clear that the United States would not be able to confine any action against Iran to airstrikes. The United States is extremely good at air campaigns, while it is weak at counterinsurgency. It has massive resources in the region to throw into an air campaign and it can bring more in using carrier strike groups.

But even before hitting Iran’s nuclear facilities, the Americans would have to consider the potential Iranian responses. Washington would have to take three steps. First, Iranian anti-ship missiles and surface vessels — and these vessels could be very small but still able to carry out mine warfare — on the Iranian littoral would have to be destroyed. Second, large formations of Iranian troops along the Iraqi border would have to be attacked, and Iranian assets in Iraq at the very least disrupted. Finally, covert actions against Hezbollah assets — particularly assets outside Lebanon — would have to be neutralized to the extent possible.

This would require massive, coordinated attacks, primarily using airpower and covert forces in a very tight sequence prior to any attack on Iran’s nuclear facilities. Without this, Iran would be in a position to launch the attacks outlined above in response to strikes on its nuclear facilities. Given the nature of the Iranian responses, particularly the mining of the Persian Gulf and Strait of Hormuz, the operations could be carried out quickly and with potentially devastating results to the global economy.

From the Iranian standpoint, Tehran faces a “use-it-or-lose-it” scenario. It cannot wait until the United States initiates hostilities. The worst-case scenario for Iran is waiting for Washington to initiate the conflict."

They will probably go ahead with the gasoline sanctions against Iran, but this really is a precursor of war. It would involve blockading - an act of war in itself. It's doubtful that gasoline starvation would work - too much of a black market would crop up- or that if they did work, it would suddenly make the Iran regime peace-loving. STRATFOR's article states:

"The Iranians signaled last week that they might not choose to be passive if effective sanctions were put in place. Sanctions on gasoline would in fact cripple Iran, so like Japan prior to Pearl Harbor, the option of capitulating to sanctions might be viewed as more risky than a pre-emptive strike. And if sanctions didn’t work, the Iranians would have to assume a military attack is coming next. Since the Iranians wouldn’t know when it would happen, and their retaliatory options might disappear in the first phase of the military operation, they would need to act before such an attack."

It's sort of like telling Barney he can put his bullet in his gun and show off a little in the Middle East right now.

"This report is republished with permission of

STRATFOR"

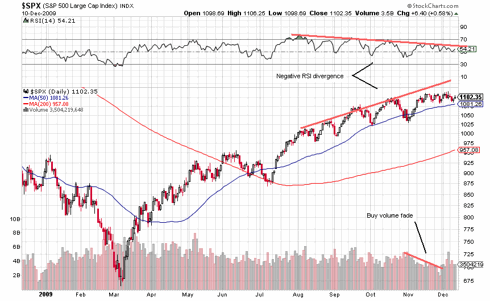

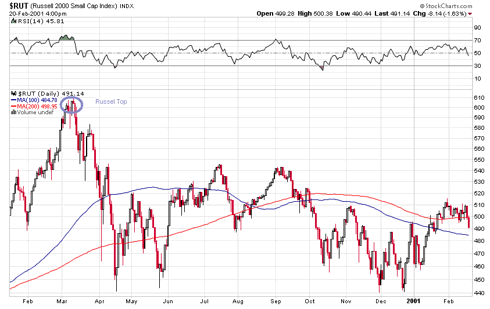

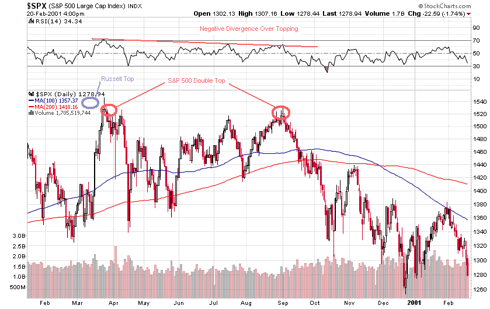

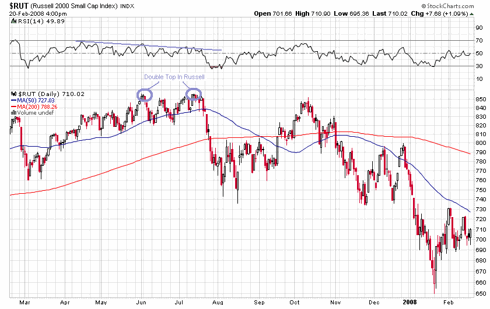

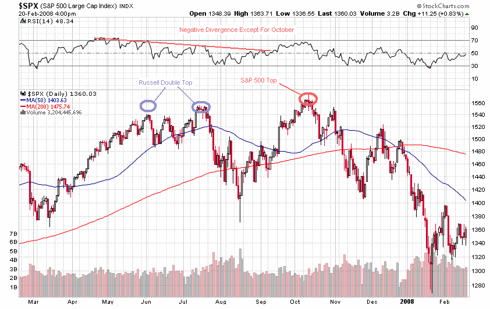

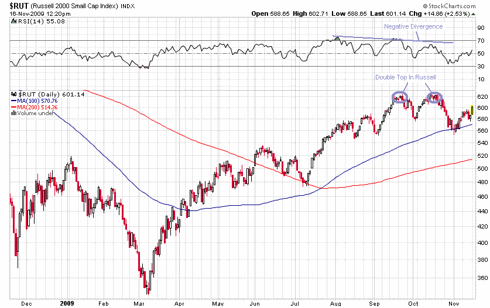

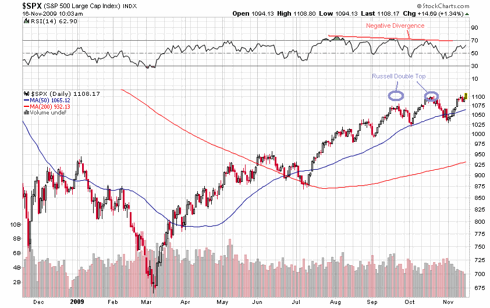

The domino effect, in my opinion, deserves more respect than most pundits and the market is giving it. Despite this view, however, I've been a bull on the market since late March. Back then, I wrote this view in a comment on a Seeking Alpha article by Bespoke Investment Group. The article pointed out a near term overbought condition predicated on the S&P being near a standard deviation above its 50 dma. This tends to occur as a single dot on a chart signaling the top of a bear bounce or as the start of a cluster of dots signaling the start of a big climb (click on link below to see article). My opinion was that it was signaling the start of a big climb, but note the caveat at the end of my comment:

S&P 500 Near Overbought Levels [View article]