The earnings season has gotten off to good start with a very positive market response, even though many point out that bars have been lowered so much, the market's reaction may not be meaningful. I've never looked to earnings reports as guages for a stock's movement. As you see over and over, the market will go up in spite of bad news or go down on good news (buy rumors, sell news). Why is that? The market is a discounting mechanism and digests far more news than you or anyone can be paying any attention to at any one time. The market has a way of moving to the tune of other, more mysterious things. This is why technical analysis is so important. It reads the full digest of all the news plus all the mysterious stuff.

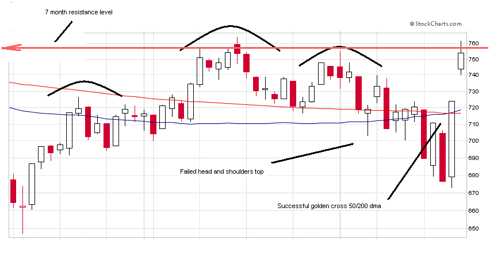

Right now, the earnings reports and the charts are putting investors in a much better mood. They are celebrating a defeated head and shoulders top formation that had so many so worried. And the glorious golden cross has received much attention too. Altogether, things have improved like so: (click to enlarge charts)

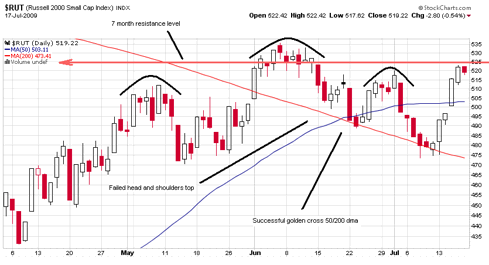

We appear ready to blast through the long resistance level going back to the beginning of the year. Does the above chart look familiar? In case it doesn't, I'll show you the current chart of our market:

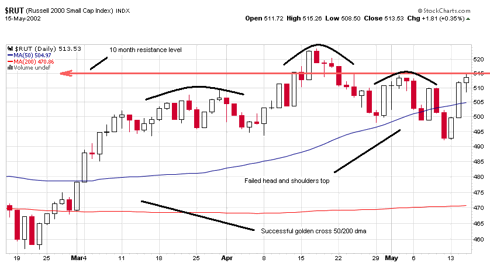

It is a repeat of all the major components in the previous chart, which is for the same Russell 2000 at the end of the major bear market rally that ran to mid 2008. The very next trading session began the market's huge collapse. The two charts are very similar in a kind of fractal way. The failed head and shoulders is more pronounced in the S&P 500 chart. This sharp up move at the very end of bear market rallies is a usual pattern as was mentioned by Peter Cooper in his July 16 article at Seeking Alpha. Did it occur at the end of the big rally going into mid 2002 before the big drop then?

Pretty much. There were a few subtle differences. It was a 10 month resistance level instead of 7 months. And the golden cross was back in January and the market had been above the crossed 50 for months. And the upsnap at the very end was a little more muted. But the major components were there.

But the macro-economic conditions are much better than these other cases you may argue. The recession is about to end for Pete's sake. Well, may I remind you that when the steep plunge in late 2002 transpired, the most powerful of the entire bear market, the recession had been officially over with for nearly a year!

Am I saying sell everything Monday morning? Well, no. But if the market doesn't break the resistance and comes back below the 140 dma, I'm going to get even more defensive than I've been since early June.

No comments:

Post a Comment