Since early June, the market's move off the bottom has been idling at a red light at a hazardous intersection (see my June 12 blog post). There are several things that make this stalling action a no man's land turning point between bull and bear, one of which has been lack of good confirmation of technical progress by the transports. Charles Dow authored a series of letters around 1900 that posited what has become known as Dow Theory. It became known and practiced because it works really well. It predicted the start of a bear market in late 2007 and now is at an interesting juncture. The basic confirmation principle says that any meaningful chart progress down or up by the market at large must be duplicated by the transportation stocks or it is suspect. If you have the S&P 500 going one way from a significant technical juncture and the transports going the other way, the theory suggests that the broad market will change direction.

Right now, the transports are having a tough time getting their ducks in a row. There are several transport indexes with some lagging the S&P badly and others lagging very badly. However, in the last week or so, some indexes have come alive and confirmed the S&P's breakage of key technical barriers while others still look very weak and nonconfirming. What is the source of the discord? It's the railroads.

About a year ago, the investment community was abuzz about Warren Buffett aggressively buying the railroads. What's up with the rails? Well, that's a subject for another post, but one key thing is the end of cheap oil. In North America, we are embarking on projects like the replacement of foreign oil with coal, tar sands, ethanol, and other fuels that are mined, scraped, crushed, grown, and hauled in lieu of simply piped. The escalating price of oil also places some aces in the hands of the rails because they can transport tonnage using less than 1/4th the fuel used by splitting the load up onto trucks and placing them in stop and go traffic. As fuel cost, not to mention conservation efforts, become a sore point, a rising oil price induces a lot of leverage in the transport biz in favor of the rails. And one thing Buffett likes about these companies is that their business has very high barriers to entry. It's very hard to start up a big rail line.

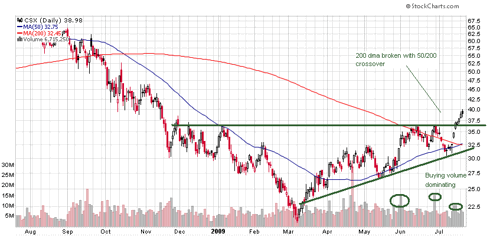

The railroad stocks began climbing in the wake of Buffett's buying, then were crushed with the market. But just over the last week or so, they have come back to life like CSX: (click to enlarge charts)

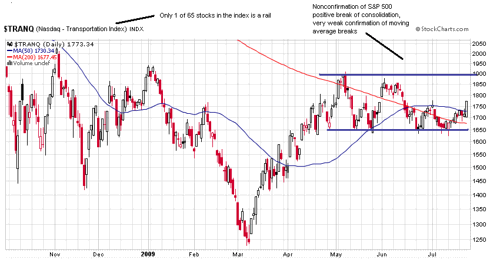

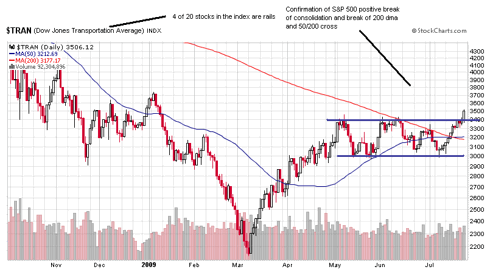

This explains the wide difference in the transport indexes:

Here we see the Nasdaq Transportation Index seeming to shy away from confirming the S&P's breaking of the 200 dma, the 50/200 cross, and the turn north out of the consolidation of the last 2 to 3 months. This index is made up of 65 companies with only 1 rail. What happens if you put a bunch more rails in?

So much better! This is the Dow Jones Transportation Index composed of 20 companies with 4 major rails - 20% of the index. Until 2 weeks ago, even this version of the transports was not confirming the good technical work of the S&P 500 having stayed below the 200 dma with the whole consolidation pattern well below the January high for the year. But with the help of the railroad breakout, that is changing.

Which version of the transports should we go by? Charles Dow might say the rails of course. That was about the only industrial transportation in his day.

No comments:

Post a Comment