These two entities, STRATFOR and Israeli intelligence, know more than the rest of us. So what do "the rest of us" think? Let's look at intrade.com for a collection of opinion who've studied it seriously enough to wager money on odds contracts. They bill themselves as "THE Leading Prediction Market" and invite you to "tap into the wisdom of crowds". This wisdom sets a probability for events of interest to occur by a certain date. For example, what would you say are the odds for Mike Huckabee to be the Republican presidential nominee in 2012? The pricing of the current contract you can buy has this chance at 10%. Turning to the markets, there was a running bet all year on the U.S. GDP declining 10% or more off the peak between Q4 2008 and Q4 2009 (inclusive). The wisdom of the crowds had this probability spiking to 50% in late February when the market was spiking toward the floor. It's currently at 0.9%. So this wisdom, as far as the markets are concerned, may be of use as a contrary indicator.

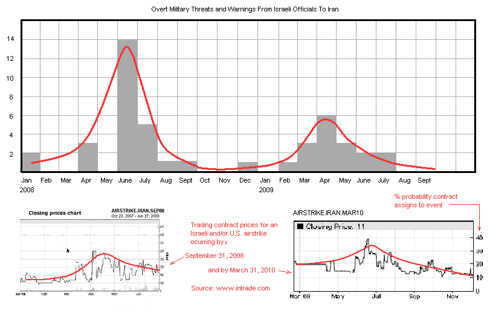

They have had a series of contracts for an Israeli and/or U.S. air strike on Iran over the last few years. I checked out the two covering about a year period for 2008 and 2009 and compared them alongside the sabre rattling out of Israel about an imminent strike. As the charts below show, there is some correlation between this sabre rattling and what the wisdom of the crowds think about a war (click to enlarge)

In both years, mid-year sabre rattling by Israeli officials roughly accompanied a chance of war outbreak spiking to as high as 40%! But then a slide into year end - current quote for a strike by March 31 is 11%.

But, as was the case with the February GDP/market outlook, the smart opinion may be just the inverse of this pattern.

The quieting pattern into year end isn't what you would expect from the saber rattlers if we are building to a blowup. But consider the observation of Andrew Apostolou and other analysts interviewed a few months ago on Israel's willingness to strike Iran.

"... it's unlikely, they say, that Prime Minister Benjamin Netanyahu will reach that conclusion in the coming weeks or months...Israel is locked in a wait-and-see mode, planning to let U.S. diplomacy exhaust itself. Matthew Silver, a historian at Emek Yezreel College in the Galilee, agrees: "Netanyahu figures, "Okay, let Obama talk to the mullahs. It's a preordained failure." That the Israeli prime minister is making loud noises about a possible military strike, Apostolou says, suggests one won't come anytime soon. "If the Israelis really wanted to scare the Americans, they'd say nothing. When the Israelis go really quiet, that's when you have to start worrying. But in the meantime, Israel will continue to match Iran's belligerent signals."

And theatlantic.com ran a July 13 article titled "The U.S. Should Worry When Israel Gets Quiet". Well, Israel does seem to have "gone quiet". Lately, their pronouncements have been preferring diplomacy if the military option is even mentioned. And now they say things like what Michael Oren, Israel's ambassador to the U.S. recently said on August 16 - Israel is "far from contemplating" a strike on Iran. That statement reminds me of the kid who denies eating any cake with chocolate smeared all over his face. It's interesting that the quiet zones in the above chart for this year and last coincide with the optimal time window of the year for a strike, September to November, when the prevailing monsoon winds keep the radioactive fallout and dust primarily in Iran and out of neighboring countries. I suspect that they were on the verge of doing the strike last year, but the financial crisis may have aborted it.

The opinion that knows, Israeli officialdom and STRATFOR, indicate the opposite of the slumping odds out to the March 2010 contract shown above. The current contract goes out to June 2010, and its current quote is a little higher at 18%. But all this would imply that the stock market impact would be severe - it doesn't seem to be very highly discounted.

No comments:

Post a Comment