A ray of sunshine on an otherwise dreadful market outlook is the condition of the transports and a key tech leader index. These rays really stand out in all the gloom. The debt dominoes appear to be catching up with the rally from 2009. But before we bury the recovery, lets look at something important that is refusing to go along with the gloom so far.

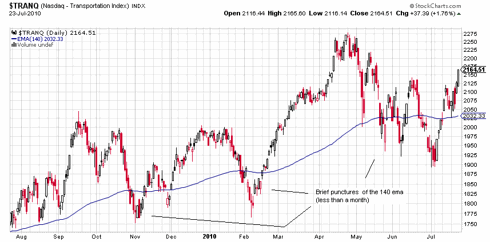

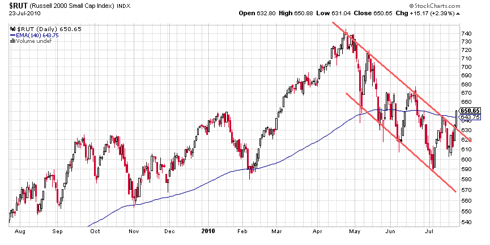

Now to fast forward to the present, we could place a line in the sand as the 140 day exponential moving average (the 200 simple is shown above). The 140 is a good divider of major bull and bear moves if you allow a month or so for transient crossings. In late June, the broad market and the transports seemed to be locked in a tug-of-war with one on bear ground and one on bull ground. Now if we take a peek at the tussle we see this:If you put any faith in Dow Theory (and you should) you want to pay attention to what the transports are doing because for a move to be confirmed in the broad market, it must be replicated in the transports. Quite typically, a change in trend without transport confirmation turns out to be bogus. This has been a reliable indicator since the days when the rails were the main transport. In our day, rails have become much less significant, but recently have taken on the role of a reflection of the commodities market. Coal, and about anything you pulverize and haul, move much cheaper in quantity by rail than by smaller truck units getting 5 mpg in traffic. That's a major reason Warren Buffett is buying up railroads. If you look at how the rails are doing in this bad market (check CSX, CNI, KSU) you see they are still in bull climb mode despite the whacking commodities are taking. To isolate the transports as a reflection of purely economic activity apart from the global commodities market, I like to look at the Nasdaq transports because they are virtually devoid of rails:Here you see pretty much the same thing as the rails show - they both are not confirming the change in trend seen in the S&P 500. The transports are proceeding on an upsloping 200 dma and may have put in a reversal stick on that trend line today. The retail RLX index has been leading the correction down and also has the look of a reversal day being put in at the bottom of a trading channel.

The transports have only briefly punctured the 140 for less than a month at a time, and look like they want to drag the broad market, with the bears kicking and screaming, back to the bull market for now:

A lot has been made of the Baltic Dry Index's sharp dive over the last couple months, and this transport index is a reliable leading indicator. But, as Cramer pointed out this week, this index is being distorted by an unusual ship overbuild situation causing shipping rates to decline (see my March 9 post here "Baltic Index On Leave Of Absence?") The other transports, including container shipping, are doing well but are more of a coincident indicator reflecting smaller lead times in economic activity. So we will just have to monitor these transports and take the longer range BDI forecast with a grain of salt for now. The ship thing just doesn't seem to be a plane and train thing.

No comments:

Post a Comment