Gold stocks are a good way to take advantage of a climb in gold because they historically outclimb the metal by a factor of 2 or better. And the stocks tend to run in 4 year cycles of under/outperformance of the metal. They are just now finishing up about a four year under cycle. But there is an alternative. It's the PowerShares DB Gold Double Long ETN (

DGP). This is not an ETF, it's an exchange traded note (

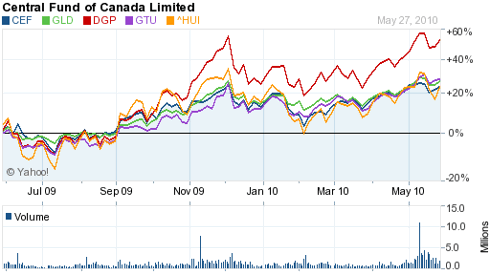

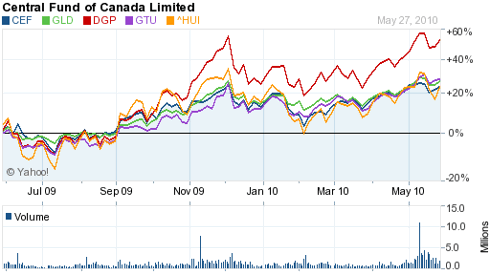

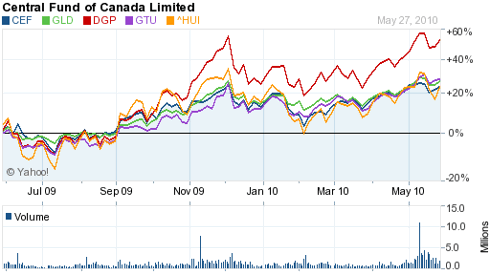

ETN) and is a debt instrument. This has a big tax advantage as it isn't hit with the 28% longterm collectible rate as ETFs are - only the 15% rate as a stock would be. The recent performance of DGP vs the popular gold ETFs:

This is over a 2X outclimbing of the metal with the same tax treatment as stocks.

No comments:

Post a Comment