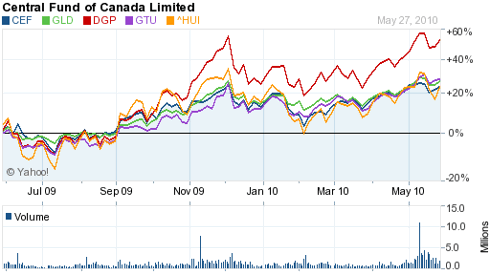

Nichols has been calling the moves of gold on a monthly scale with amazing accuracy. His day to day projections are more hit or miss, but on the month to month range, his analysis is astonishing. For example, in his 2/25/08 report, he had been saying buy gold under $900. "The plan is to now to hold on to these long positions as gold climbs to the major target of $1010 over the coming weeks." He fine tunes his prediction: "There's a good chance it will overshoot the $1010 area and extend quickly up to $1040. But it may not survive for long over $1000 ... there is the potential for a multi-month top to develop after this push." So what happened ?

Whatever this guy's smoking, I want some. Nichols does pure chart analysis, but he is well aware of gold's basic fundamentals. In a September, 2007 statement, he says, "The most important investment theme for the next 10 years will continue to be the frenzy for tangible, hard assets ... and the best market to take advantage of this monumental trend is gold."

So here is where a fork in the fractal road is developing. Those of us who see a continuation of the currency/demand induced commodity bull market for years may have trouble digesting the 64 month bull market fractal that Nichols has recently posited as beginning with the parabolic sprout in September 2005 and abruptly ending in February 2011. It's enough to give a fiat money hater indigestion. In my article linked above on the 64 month bull fractal, I point out the amazing prevalence of this fractal - it's everywhere. And gold is showing all the signs of following this pattern. So do the world's debt and currency problems all go away over the next two months ? Does the commodity bull cycle suddenly end now ? Has Nichols changed his mind about the investment theme for the next 10 years ? In 2008, he stated "this bull market in gold should last for many more years." His 64 month gold fractal seems to contradict this.

As I show in my article, there are examples of this 64 month parabolic fractal not ending a bull climb, but it presents some serious problems to the basic bull case for both gold and silver. Let's consider the basic phases of the gold climb, or any large scale parabolic climb. It is often described as three phases. Phase one is where the sellers have mostly had enough of the bear, and supply/demand slowly exert an upward bias, but there is little investor interest. Phase two is where professional investors slowly begin an allocation change back to normal levels, putting gold into a stable climb for years. Phase three is when the professionals have built an allocation level to around 5% to 10%, but the retail investor has yet to embark on the mania. Jim Rogers likes to ask his audiences how many are gold holders and at what allocation, and he is amazed at how few of these pros are holders to any extent. Early this year, the fund allocation level was estimated at around 0.4%. Jim Cramer reckons the pro ownership level now at still less than 1%, and he says that is way too low. The phase two pro accumulation is a slow process, as opposed to phase three. There was an interesting article over at The Daily Gold back on March 7 titled "Gold Is Not Going Parabolic Yet" where they note we're not even through phase two yet and even phase three takes time to build: "As the Nasdaq bubble proved, the seeds for a popular speculative mania are not sown overnight (or even in a few months). It literally takes years to prepare the soil of popular psychology for a mania." This phasing process, which is a steady acceleration into the parabolic top, does not fit well with the 64 month fractal and the gold parabola suddenly ending in February, 2011.

Another misfit in the puzzle is silver. In my article "Is Silver Money" I point out that every time in history where gold essentially becomes a currency, silver becomes valued, not per its industrial supply/demand, but at its abundance ratio with gold 16:1. If it goes there in this gold move, that implies a rise in silver to $150 if gold goes to $2500. Silver moves in parabolas even more so than gold, and you would think it would achieve this kind of price at the parabola's end. But the 64 month parabola constraint forces a rise from the $20s to $100 or more in just two months. That's asking a lot - even from silver. Silver's industrial supply/demand condition, by the way, has reached a truly historic point where the above ground stocks have been depleted to essentially zero compared to its run in the late 70s. Since then, a computer/electronics revolution has happened, placing immense demand on use of silver as the world's best electrical conductor. The artificial suppression by big money interests on the silver price has resulted in a long, long climb in the offing, more of a parabola than can be reasonably fitted into the 64 month fractal.

So what right does this fractal stuff have to upset the applecart of sound fundamental considerations ? Maybe we should just forget all about this fractal hocus pocus. Well, not so fast. Nichols seems to have only recently stumbled upon the 64 month thing. But just maybe there are other scales of this same fractal out there that we should be thinking about.

First, you have to consider the basic structure of this fractal. It is composed of two parabolas separated by a distinct downtrend phase about midway. For examples, look at the currency parabola of 1920s Germany and the stock market of Denmark in the 90s: (click on charts to enlarge)

The shapes of the components vary, but the structure keeps recurring with the downtrend in the middle being a year or less with the overall time within a couple months or so of the 64 months. This is by far the most common scale of this fractal. But it does seem to occur in other sizes. There is a 3 year version. As examples of this, look at Homestake Mining, the premier gold miner of the '30s, and the Brazilian inflation of the early '90s:

These fractals do the same thing in different scales. That's what fractals do. They are all different with the only common denominator being that all the main components are sized proportional to the overall size of the fractal. The 3 year mid-course downtrends are small, less than a year, and barely noticable; but they're there and much more clearly seen in the amplified versions of this fractal.

Could it be that there is a much larger scale of this same fractal that gold may actually be following in lieu of the common 64 month size ? Does such a thing exist ? It very well may. Look at these examples: the Thailand stock market of the late '80s and early '90s

The large size seems to cluster around about a 9 year length with everything scaled up including the variance on how long it runs and the duration of the downtrend in the middle, which runs around 2 to 3 years. The next example is the stock market of Turkey

This 9 year iteration has the mid-course downtrend run a whopping 3 1/2 years. This is also an example of a parabolic rise not meaning an end to a bull market as is commonly thought. The Turkish market could hardly be considered busted when the parabola was over. The next king-size example is the Australian dollar

Given that the downtrend size in the middle ran a little over 2 years, you get the impression it wanted to run to more like the 9 year length before being interrupted by the end of the world in late '08. A less pronounced version of this large size fractal was the Dow in the '50s

Big and gentle, this occurrence was not followed by a collapse, but by the big flat Dow of 1966 to 1982. A more typical large size was the Swiss stock market of the '90s

There is one other pertinent example of the large version of this fractal, and that was gold in the '70s. It featured a two year downtrend in the middle in 1975 and 1976. The length of this downtrend is about the most reliable predictor of which scale fractal is being carried out. The distressed buy and holders of gold during those two years would like to have known this basic fact back then. Well, we here in 2009ville know. This time around, the mid course downtrend gauge has been completed as of a little more than a year ago, and it was nearly two years, suggesting that it is indeed the large scale fractal we are in, replicating the previous gold bull

An 8 or 9 year scale of the fractal would make all the previously discussed pieces of the puzzle fit a lot better. It would allow silver to more reasonably return to an inflation adjusted peak commensurate with what it did in the late '70s

Here we see the larger scale mid-course downtrend size even more clearly to be the 2-3 year type, tightly correlated with the larger fractal.

So, should we fractal followers dismiss the 64 month parabola in our current gold market ? The investment implication of a blow-off parabolic top ending at 64 months is a hold of gold and silver going into January, and a serious round of profit taking after that. Then, if you are really bold, you could short gold coming hard off the end of the parabola. But this could be really dangerous because gold could sharply rebound at any time into a renewed bull market as the examples above illustrate. The implications of the larger size fractal are that we are in the early stages of the 2nd parabola, where you probably just want to take positions in the good miners and not try to be too cute timing around the shorter term moves in the gold price.

But what if you're not sure, and we are at a gigantic fractal fork in the road ? Well, it may be wise to closely monitor the technical condition of gold these next two months, and fade the sector if there is any serious breakdown beginning. Any such move should advertise itself in the appropriate technicals. But there couldn't be the end-of-parabola collapse if there is no end-of-parabola blow-off topping action. And, well, we are getting long in the tooth for such action to begin here at the end of December. The price action now in gold is quite orderly. Nichols is now referring to "the delayed launch" of the parabola ending frenzy per his current 64 month outlook. The technicals tend to favor the larger 9 year type pattern developing right now, but there is the very important fact that the 64 month is by far the most prevalent and seemingly most forceful version of the fractal. So maybe we should give it the benefit of the doubt until proven otherwise. It will be an interesting show to watch the next few weeks.