The second of this 3 wave attack is the sugar/oil link that I wrote a post about back in June. About 60% of the world's ethanol is made from sugar, and when you have the oil price rising, you have added pressure on biofuel demand, which competes with food demand. If the global economy normalizes soon, the now crippled supply mechanism, that wasn't able to keep up with demand 2 years ago when it was going full blast, may induce a surprising price run in oil. By the time the monsoon effect wears off, we may have the return of high crude keeping sugar at elevated levels.

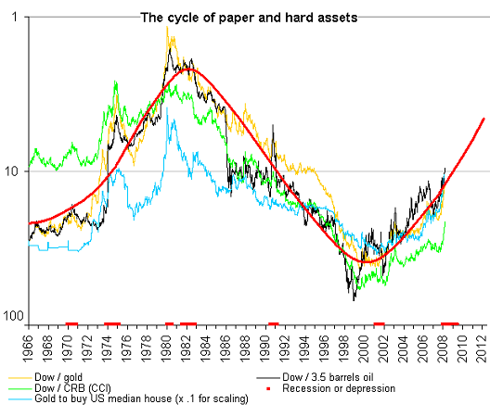

But now let's focus on the third wave, as if the first two weren't enough. This is simply the investor demand for sugar, to go along with the food demand and fuel demand. As with commodities in general, there is investor demand for hard assets when paper assets are threatened, as in any major recession, with monetary policy and currency debasement. In general, however, this runs in major cycles and we are now in a major up cycle: (click to enlarge charts)

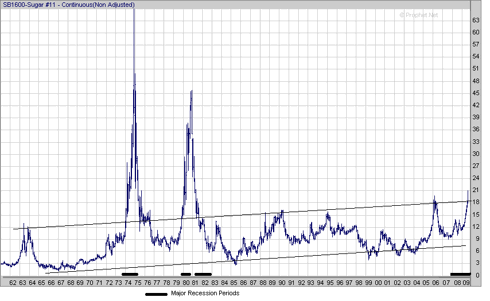

Those who say the commodities bull is over are probably wrong. The above map puts us somewhere in the middle of the present up cycle with the most powerful climbs yet to come. So we are in a major up trend toward investor demand for sugar as we were in the last two major recessions. Sugar loves major recessions by the way:

I think you could rank our current recession on a par with '74-'75 and '79-'82, so where is the sugar spike? We may be starting it. The normal trading channel seems to be breaking. Sugar has a lot of catching up to do just to catch up to inflation. As the above chart shows, you could buy sugar last year for what you paid for it in 1963.

The macroeconomic picture is a lot different for sugar now than it was in the two previous spikes. We did not have peak oil and rampant ethanol production back then. We did not have the exploding emerging market demand for sugar as both food and fuel. If there is a major spike from this triangulated tsunami, it may not recede as rapidly as in the previous cases.

All the good sugar stocks trade on the non U.S. exchanges. Here in the States, there is IPSU Imperial Sugar, which is breaking out of a brutal downtrend of about 3 years, but without really good fundamentals. Then there is CZZ Cosan, the Brazilian sugar company. Less volatile and dangerous is ALEX Alexander and Baldwin, the Hawaiian sugar company that has some diversification into real estate. SGG is an ETF that tracks the sugar price.

No comments:

Post a Comment