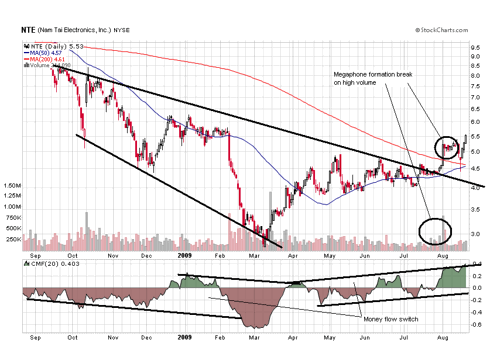

This company is based in China, but serves Asia and Japan as well. As is noted in Global Advisors Look To China you don't often find a stock selling at the amount of cash on hand per share, but with $5 a share in cash, NTE is just that. Price/sales is 0.4 and price/cash flow is 6.7 and PE is 8 and they are dialed into the smartphone market growing at about 30% per year (globally - probably faster in China). The article also notes that the stock has "been been beaten up and left for dead" as the chart attests: (click to enlarge)

Look out, it's regaining consciousness. It's still down for the year, but probably not for long. That may change at 9:30 AM tomorrow.

No comments:

Post a Comment