Gold's technical condition (including its fractal condition) tells you more about its direction than trying to figuring out inflation, deflation, or conflagration. Going outside the charts, we see an abundance of fiscal angst being highlighted by the ongoing bailouts, including the one for our dysfunctional healthcare system that many believe will be a fiscal nightmare. But just staying with the charts, we see some interesting things: (click to enlarge)

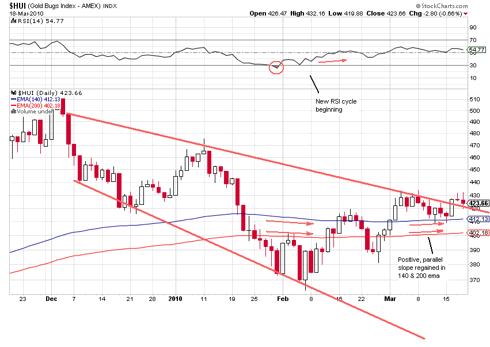

Here we see a clear downsloping megaphone formation for the HUI index of gold stocks formed over the four months of the correction since December. These formations tend to break violently when they finally break (either up or down) out of the boundaries. You could think of a megaphone as announcing that a big move is coming up. The gold stocks have cooled enough to put a slightly negative slope in the 140 and 200 day exponential moving averages. But as we approach a possible exit point from the megaphone, the moving averages have regained the parallel and positive slope they've been in for months, signaling that the gyrations inside the formation may be about done with. Also, a clear oversold condition has been registered in the RSI and a new RSI cycle seems to have taken hold.

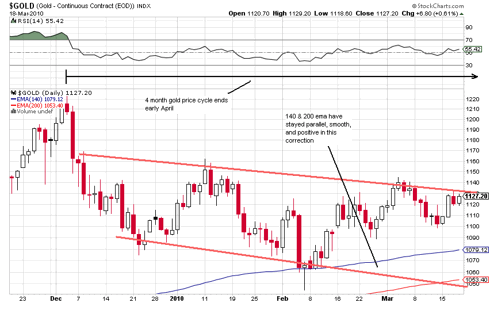

Looking at the gold price chart, we see a more subdued megaphone:

The moving averages look sturdy despite the long correction, suggesting a very powerful trend and a strong climb once the correction ends.

The fractal students of gold have been very accurate on gold's direction in recent years. They project late March as a major turn date, just as they did prior to last July (the beginning of the big climb into December). They point out that gold has moved up and down in 4 month units - either single 4 month units in one direction or a mild 4 month move followed by another more severe 4 month move in the same direction. It's interesting that our present down move hits its four month mark in early April, just when the above technicals are suggesting a new move coming, and in the aftermath of the upcoming congressional actions on healthcare. Storm-chasers beware - it could be a perfect storm gathering for gold.

The rest of the market has had to deal with all these known problems as well as the fiscal dominoes abroad out of Dubai, Greece, and every other place the debt roaches are hiding; but it has somehow chosen to ignore all that. So we could have the 2004 condition of gold and the S&P 500 both moving up (although '04 was a little flat and boring). Of the two, I would say gold has the best and by far the safest performance outlook.

Marketsare always predictable, so are parachutists - but they always folow gravity. Gold is not priced in dollars, rather the opposite which is why with inflation yet to fully manifest. This "fear of deflation" is just a ruse by central banks to keep inflating the money supply. Deflation does not keep people from spending – they always spend what's necessary. And money NOT "spent" is then saved which means it is credit to someone who invests it for capital goods etc. thus it is again being spent, only not for consumption. Money never lies completely idle to any extent whether there's inflation, deflation, stability or a solar eclipse. For deflation to seriously happen, not only the current extreme credit expansion by the central banks and states (through "quantitative easing", stimulus packages, monetising and then spending national debt etc.) but also the money that was released into the economy PRIOR to the collapse would have to be "mopped up" again. This is nowhere to be seen nor would it be technically possible (confiscation aside) so we will rather see inflation than deflation.

ReplyDeleteMaven - I tend to agree that inflation will wind up being more the problem. Every crisis we encounter is fought with currency debasement and the thought that we will grow our way out of fiscal irresponsibiity. That may be true - until something happens to block the growth escape route. Such a thing may be the global oil production peak and idiotic oil replacement energy policy. For many decades now, world leaders have been spoiled by the ease of growing and affordable energy supply, without which industrial growth can't happen. That era is in danger of coming to a close if we don't get smart soon about replacing the energy growth we've come to expect from crude.

ReplyDelete