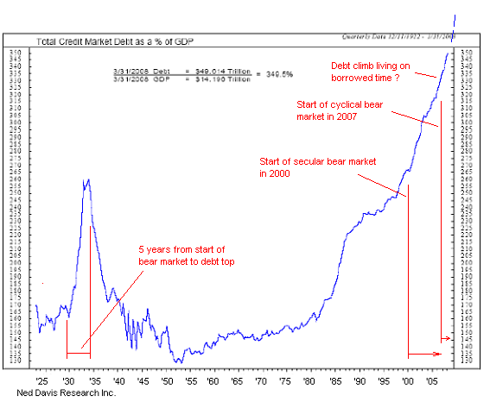

But is it fair to blame everything on debt? In the Great Depression, the chart shows the debt mountain came after it started as a result of the efforts to fight it. There are many who argue that the Depression was so bad because it should have been fought with more debt, not because there was too much New Deal deficit spending.

Well, we are certainly going to test that theory in our day. Since the mid '80s, we have been using debt to fight everything from a hangnail to a systemic collapse of the system. We have put the pedal to the metal and we will shortly see if more is better.

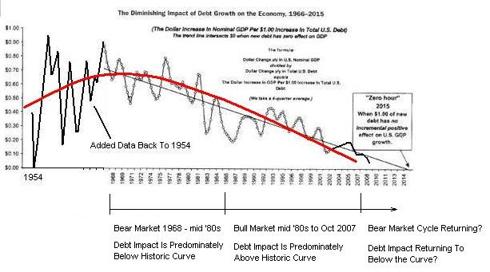

Is there any way to guage the effectiveness of all this debt we have been applying to the system's problems over all these years? There is a fascinating graph Dr. Marc Faber uses to show this. It was featured in a piece at Seeking Alpha 6/14/09 by Faisal Humayan. If you add some data points going back to 1954, when the current debt mountain began its build, and extend the current part to include Q1 of '09, you see this:

This chart shows a Y axis going from 0 to 1.00 tabulating the dollars of GDP growth we get from each dollar of added debt. You can see a larger scale version of this chart at the Cumberland Advisors site pdf (page 6). Marc Faber uses this data to show that we are getting weaker and weaker GDP growth for each new dollar of debt added to the mountain. He shows a straight line fitted through the data that goes to zero in 2015, "Zero Hour" when piling on more debt gives us nothing in return.

But if you add the data going back to the start of the mountain in 1954, you could also fit a curve that winds up going to zero sooner than the straight line fit. I hate to be even more of a kill joy than Doctor Doom, but I think the curve fits things better.

So is this what putting the debt pedal to the metal gets us? We are getting to a point where we get zero GDP growth for each debt dollar added, but we dare not lift our foot off the pedal or things will be even worse. Where is this joy ride going next? There is a limit to adding debt. Sooner or later something will break - a currency or something.

No comments:

Post a Comment