EROEI is simply Energy Returned On Energy Invested. It was not even a word back when Jed Clampett could start a bubblin' crude when he was out shootin' for some food. But as we started drilling deeper to recover oil, people like Cleveland and Hall began tabulating estimates on how much of our energy supply was being used to find, drill, and use our new energy finds. They come up with about a 100 figure for oil of the 1930s (1 barrel of oil burned to get 100 new barrels online). This had dropped to around 30 by the 1970s as so much of the easy to find oil in the world's elephant fields in naturally pressurized reservoirs has already been exploited. EROEI for oil and natural gas now is running around 8 - 11 depending on locale.

That is a huge drop from the 100 EROEI of the 1930s, but as it turns out in the math of net energy, it's not that big a deal. What is a big deal is what happens as this EROEI number goes from around 8 to below 4. (click on chart to view charts)

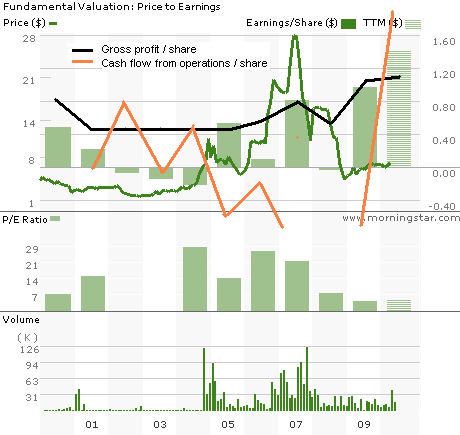

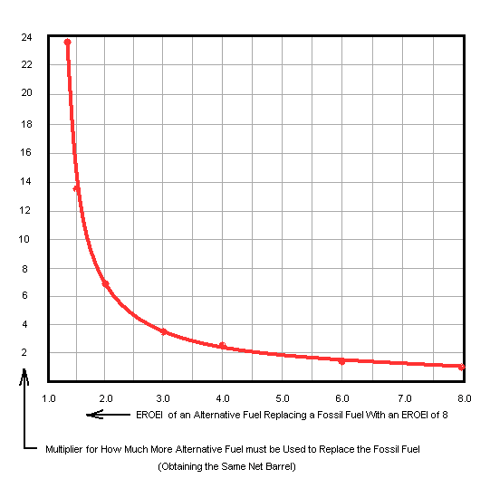

This chart, constructed by Dr. Euan Mearns, an editor at theoilddrum.com, plots net energy as a percent from 100 down to zero over EROEI's range from very high down to one, where it is taking a barrel of recovered energy to obtain a barrel of new energy (no net energy to use). As you can see, we're in fine shape as long as EROEI keeps north of 8, but we fall and we can't get up as we go over the cliff as EROEI goes to 4 and below. This is an exponentially increasing problem as we try to replace peaking crude production with things like corn ethanol, which is a worthless solution. As this oil replacement scale shows

corn ethanol, at an estimated EROEI of 1.3, must be produced at a rate of over 20 barrels for each barrel of oil it replaces energy-wise! Many biodiesel, solar, and electric EROEI estimates aren't much better.

You see a lot of barrel count estimates of future oil production as we deal with peak oil, but as we go over the top of the conventional oil production peak (the evidence suggests we already have) the flood of "alternative" liquids such as tar sand oil, deepwater, etc. are severely challenged to come close to matching crude's EROEI. This makes a big difference in how much net energy is actually being delivered to society despite the raw barrel count. This makes a good EROEI estimate of any new alternative fuel critically important - its most important feature. But nobody is paying any attention as we approach the net energy cliff.

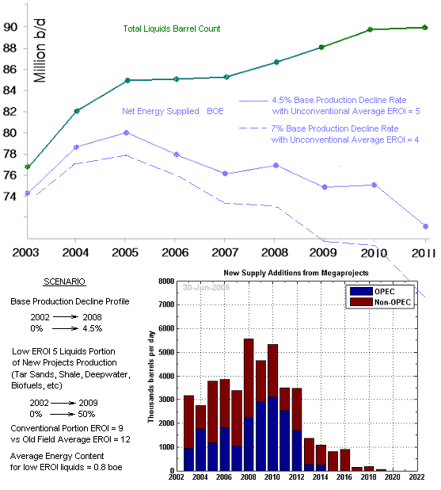

If you were to do an adjusted production curve to get an estimate of a "net energy curve" based on best current estimates on EROEI of the various nonconventional oil liquids going into the barrel count of official oil supply, you get a much different curve than the official projections (which all our energy planning is based on)

The two curves are for the more traditional base production decline rate estimate of 4.5% annually and for the newer estimates suggesting this to be around 7% - so a kind of best and worst case range is shown. The EROEI issue becomes acute as we go past about 2011 unless something radical is done about the low EROEI oil replacement theme that is now so entrenched in Congress, which seems dedicated to any alternative energy in direct inverse relation to its usefulness in actually replacing oil. They dote on corn ethanol because of a powerful corn lobby. They slight lightly lobbied natural gas in favor of the black lung clean coal coalition. They reward anything that will take decades to scale up as an oil replacement and ignore the one viable thing that's already at the scale and the EROEI needed - natural gas.

Obviously, replacing oil is going to have to be a team effort from many things - renewable ethanols, solar, wind, and the best currently available bridge to all those future fuels - natural gas. But we're going to have to pay a lot more attention to the EROEI science of all these team members, or we're not even going to make the playoffs.