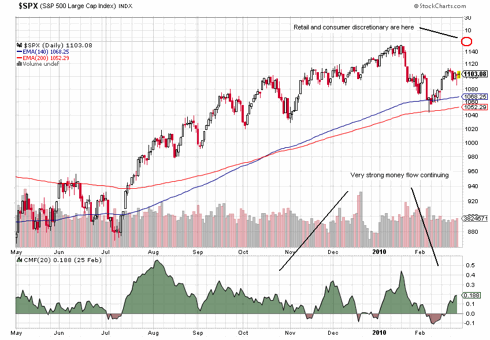

First let's look at the broad market, the SPX (click to enlarge charts)

The leader that's bullish is retail and consumer discretionary spending as the first chart below shows. In this stage of lousy housing, lousy employment, and a lousy consumer, this would be about the last area you'd suspect of being a general leading a charge upward. Go figure. But this group has been right about the market's direction for a year. In addition to the consumer's leadership, the SPX has nice, positive divergence in the two key moving averages, the 140 and 200 ema, and the price action is staying nicely above both throughout the pull backs - a very good sign.

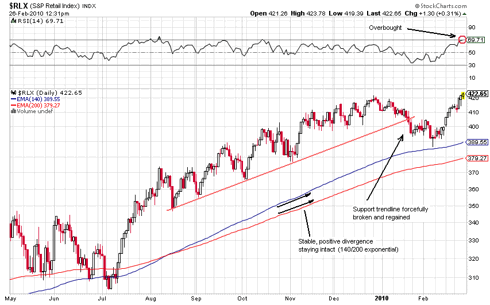

The bullish leader of the three is retail and consumer discretionary (RLX and XLY)

Here we see the index way ahead of the SPX in coming out of the recent downdraft even to the point of being at a new high and currently overbought on the RSI ! The market somehow doesn't seem think the U.S. consumer is all that crippled. A nice, smooth positive divergence in the 140/200 is ongoing.

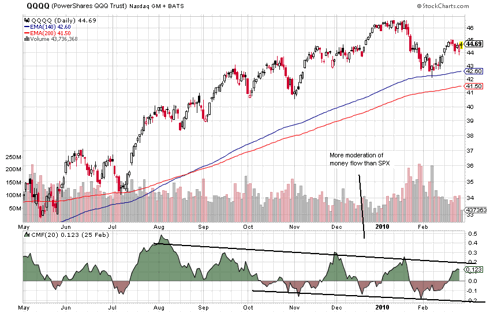

Second, look at the tech stocks.

This group is neutral with the SPX to maybe slightly lagging considering the money flow condition, which is cooling. This all paints a picture of maybe some leadership rotation in a more sideways market - a point that Jim Cramer has alluded to.

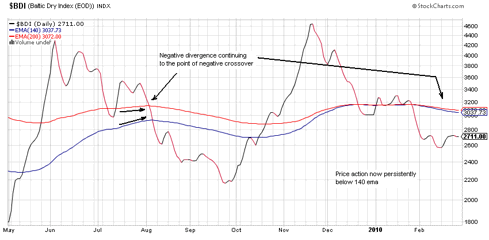

But the third index is a little more worrisome, the Baltic Dry Index.

Here we see a much different look with the 140/200 ema. Even more worrisome is the fact that this one is the early warning system for all the others. It had better get back above a climbing 140 ema soon. Both the BDI and the Shanghai Index are all about China, but the Chinese stock index doesn't look this bad with the price action staying above its 140 ema. If you check out the $DJSH, you see a moving average picture more similar to the SPX albeit lagging behind it a little. Maybe all that is a little over-reaction by everyone in response to China's recent move in the direction of putting the brakes on their economy. But in the bigger picture, this is a good problem to have.

No comments:

Post a Comment