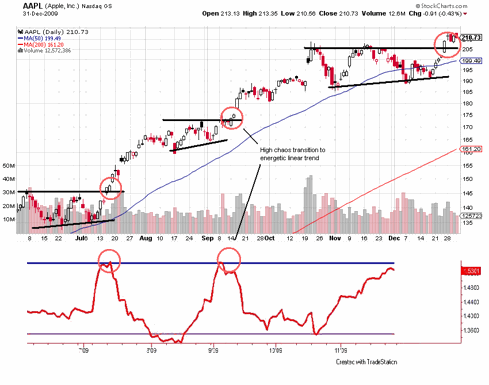

Chaos theory seems to be agreeing with what the leader groups are suggesting for the direction of the stock market. As I've posted on often, these groups have consistently been calling the next moves, and if you look at the QQQQ tech chart now, it is telling you which way is next. And if you look at the chief of the tribe, Apple, and apply a little chaos theory, you see this: (click to enlarge charts)

AAPL has broken the funk of the last couple months to the upside. The red chart below the price chart is the FDI (Fractal Dimension Index) which is a measure of energy buildup as a market cycles between periods of high and low chaos. Energy is expended as a strong linear trend transpires. A high FDI doesn't tell which direction the move is going to be, just how much energy has built up for it. (Apologies for not having the up to date FDI - I borrowed this read from Matt Trivisonno. I'm working on an FDI for my computer, need to work out some programming)

The direction of AAPL, this critical leader stock, is I think pretty clear, so what does chaos theory say about how energetic the following move in the broad market may be?

Wham bam o' lam! This is an extremely high reading for the FDI, but this is just a daily chart. But still it suggests at least a short term pop. This strangely enough agrees with what the Dow has been doing for the last year - closely following a fundamental recovery. You can debate the artificial stimulus sugar buzz approach, and what is real or not and how it will end. The chart below refers to the PPT (Plunge Protection Team). But the fact is a "V" recovery is proceeding and the market is shadowing it:

Here, perhaps the two things the stock market cares about the most, employment and housing, are superimposed on the Dow. Two things are immediately obvious. First, the market is doing a "V" that closely matches the economic figures. Second, the market is now sharply lagging the "V" suggesting an upside run. The above chart is from an article by Gary Dorsch over at Safehaven titled "Commodity Super Cycle" Ready to Rumble in 2010. He shows several other "V" s besides the set of figures shown above, and this all suggests a move up in stocks, which the magic of chaos has already figured out.