The real test of these precarious spikes out of decline mode will come next week with the market's reaction to the wretched earnings and guidance that will replace all the nice rally talk. If the market has only mild or no reactions, then it won't be just another two week flying knife bear bounce anymore.

I've been expecting a good climb through the middle of the year '09, although I thought there would be a very sharp panic stricken VIX 80 dive to preceed it, which didn't happen. Major moves down such as we've had since '08 usually end that way. I'll take any kind of good move up I can get; but I suspect that toward the end of the year, it'll be ugly again. There are too many debt dominoes yet to fall. Apr 03 20:26 pm |Rating: +2

0

0 |

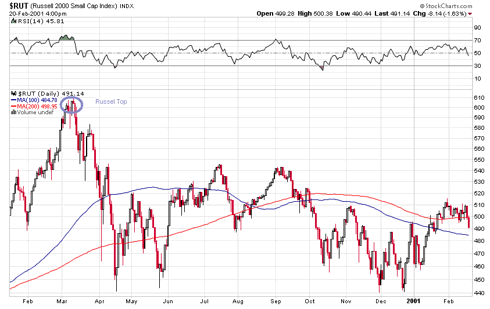

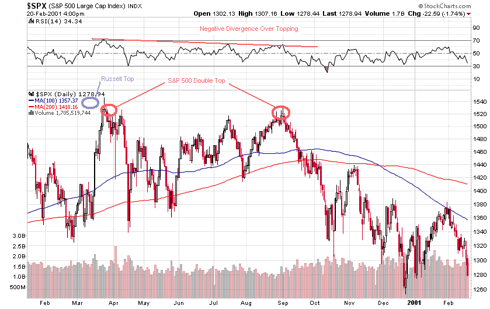

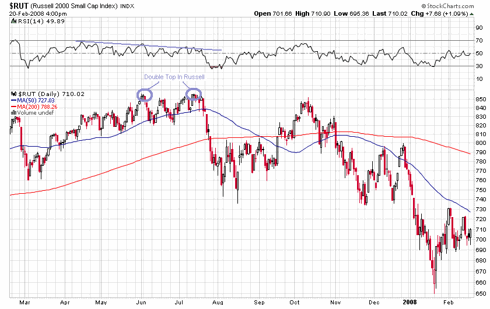

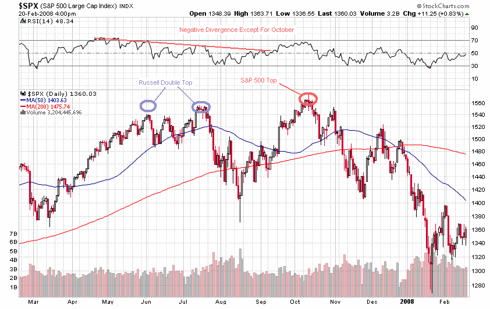

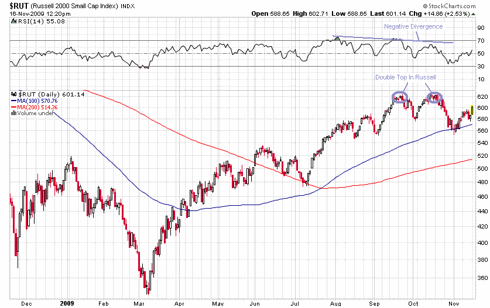

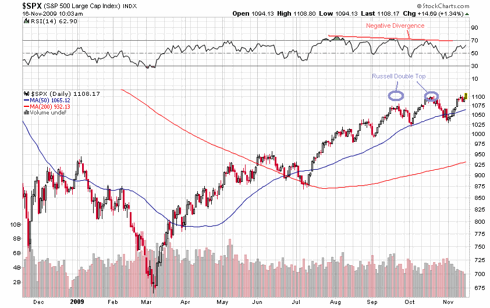

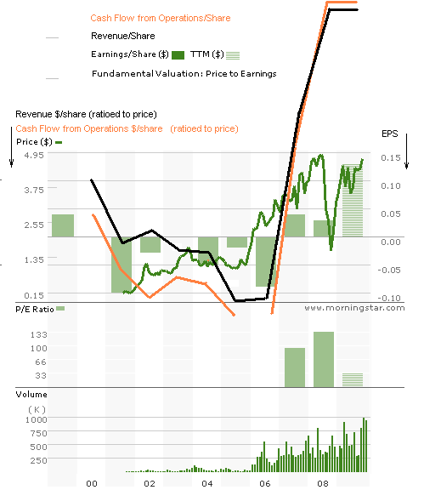

|We certainly have had the good climb since April 3 when I wrote that. I hope I'm wrong about the debt domino ugliness at year end, but it's hard to stop a domino field from proceding once the first one has been tipped. I've backed off to neutral on the market mainly because of how the small caps are behaving vs the big caps (see my Nov. 16 post) but Iran and now Dubai are problems as well. The leader groups that have faithfully called the market's direction all year (RLX, BDI) would have maybe a couple month's of mild consolidation and then more upside. But those dang dominoes! When a fool's ski resort in a desert in Dubai can hammer down your shoe maker's stock headquartered in Des Moines - well, that's dominoes for you.

The domino effect, in my opinion, deserves more respect than most pundits and the market is giving it. Despite this view, however, I've been a bull on the market since late March. Back then, I wrote this view in a comment on a Seeking Alpha article by Bespoke Investment Group. The article pointed out a near term overbought condition predicated on the S&P being near a standard deviation above its 50 dma. This tends to occur as a single dot on a chart signaling the top of a bear bounce or as the start of a cluster of dots signaling the start of a big climb (click on link below to see article). My opinion was that it was signaling the start of a big climb, but note the caveat at the end of my comment:

S&P 500 Near Overbought Levels [View article]